409A Valuation vs Preferred Share Price: Why They're Different

One of the most common —” and costly —” misconceptions among startup founders and CFOs is assuming that the 409A valuation should match the price investors pay for preferred shares. It shouldn't. Understanding this distinction is critical for issuing stock options correctly and staying IRS-compliant.

409A vs Preferred Price

Understanding the critical difference

In fact, a 409A valuation and a preferred share price are designed to measure two very different things, under very different assumptions. Understanding this distinction is critical for issuing stock options correctly, staying IRS-compliant, and avoiding unnecessary tax and accounting risk.

Understanding the difference between preferred share pricing and common stock fair market value is a core concept covered in our complete guide to 409A valuations for startups.

This article explains why 409A valuations are lower than preferred share prices, how the difference is calculated, and what founders and CFOs need to know in practice.

What Is a 409A Valuation?

A 409A valuation determines the fair market value (FMV) of common stock for the purpose of granting stock options in compliance with IRS Section 409A. For a deeper dive into what a 409A valuation is, see our fundamentals guide.

It answers one specific question:

What would a willing buyer pay today for common stock, given the company's current risk, stage, and capital structure?

The valuation must reflect:

- Illiquidity

- Downside risk

- Preference structures favoring investors

This is why the result often surprises founders —” especially after a funding round.

What Is the Preferred Share Price?

The preferred share price is the price investors pay in a financing round (Seed, Series A, Series B, etc.).

That price reflects:

- Negotiated terms

- Future upside expectations

- Liquidation preferences

- Protective rights and control provisions

In other words, preferred pricing is not a neutral market value —” it's a strategic investment price.

Why 409A Valuations Are Lower Than Preferred Share Prices

1. Different Share Classes, Different Rights

Preferred shares typically include:

- Liquidation preferences

- Participation rights

- Dividends

- Anti-dilution protections

Common shares —” the subject of a 409A valuation —” do not.

Because preferred investors get paid first in a downside scenario, common stock is inherently riskier and therefore worth less.

2. The Illiquidity Discount

Common stock in a private startup:

- Cannot be freely sold

- Has no public market

- May take years to realize value

A 409A valuation must apply an illiquidity discount, reflecting the lack of exit options for common shareholders.

Preferred share prices do not include this adjustment.

3. Risk Is Allocated Down the Capital Stack

In a liquidation scenario:

- Creditors get paid

- Preferred shareholders recover capital

- Common shareholders receive what's left (if anything)

This risk hierarchy is mathematically reflected in a 409A valuation —” but not in the preferred share price.

4. The Role of the Option Pricing Model (OPM)

Most early-stage startups use the Option Pricing Model (OPM) to allocate company value between preferred and common shares.

OPM models:

- Exit probabilities

- Volatility

- Capital structure

- Liquidation thresholds

The result is a discounted common share value relative to the preferred price —” often by 30—”70% in early stages.

This difference is not a loophole —” it is the expected outcome of a compliant valuation.

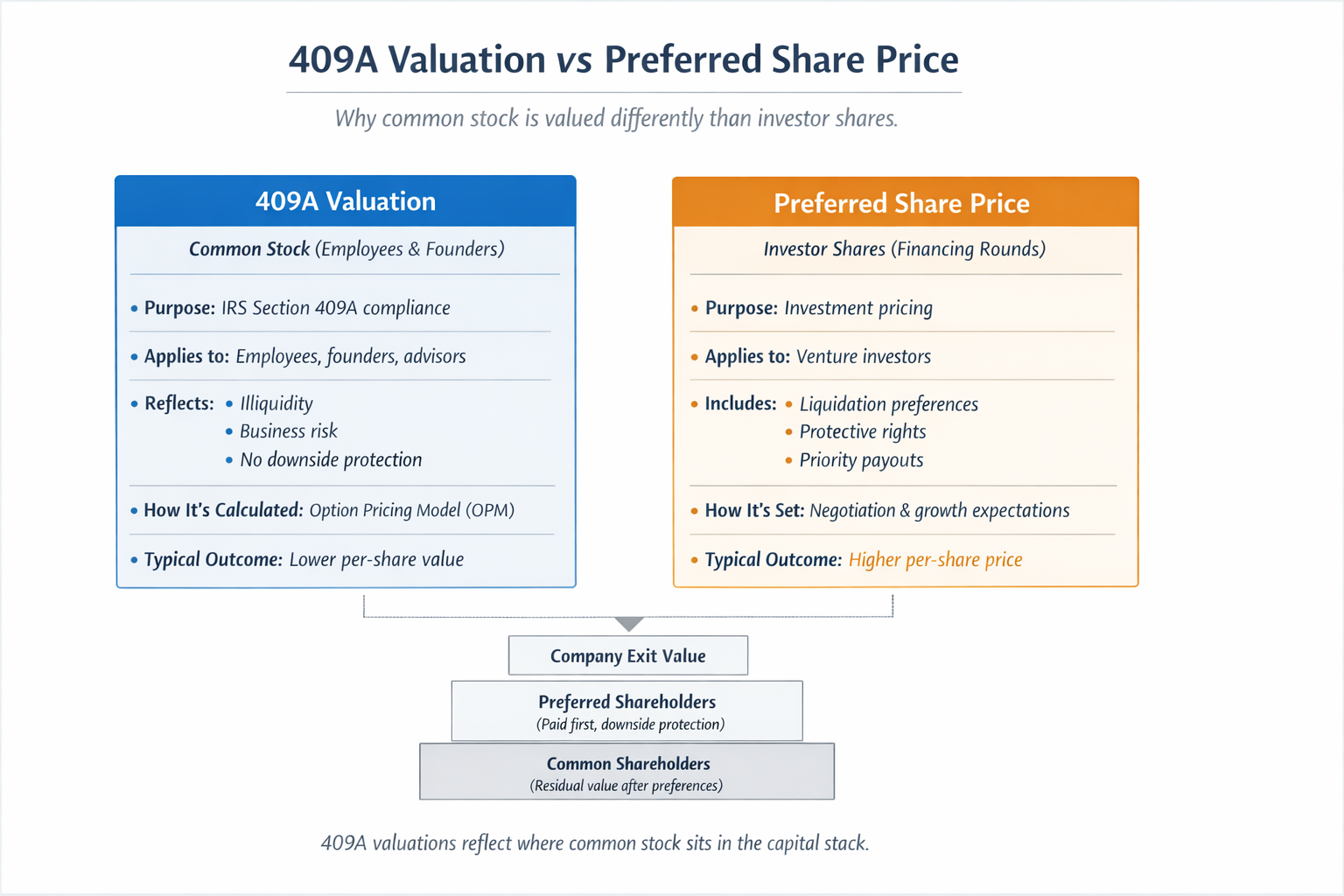

409A Valuation vs Preferred Share Price

"409A valuations reflect where common stock sits in the capital stack."

This difference is expected —” and required —” for IRS-compliant 409A valuation.

Why This Difference Matters for Founders and CFOs

Issuing Stock Options at the Wrong Price Is Risky

If founders or CFOs assume the preferred share price equals FMV and issue options accordingly, they risk:

- Overpricing employee options

- Reducing equity incentives

- Creating retention issues

Worse, underpricing options below FMV due to incorrect assumptions can trigger:

- IRS Section 409A penalties

- Employee tax liabilities

- Loss of safe harbor protection

Investors Expect This Difference

Experienced investors expect:

- Preferred share price ≠ common stock FMV

- A defensible, independent 409A valuation

- Clear documentation showing how value was allocated

If your 409A valuation is too close to the preferred price, that can actually raise red flags.

Common Founder & CFO Questions

"Our Series A was priced at $2.00 per share —” why is our 409A only $0.60?"

Because:

- Preferred shares include downside protection

- Common shares absorb risk

- OPM allocates value based on exit scenarios

This gap is normal and expected.

"Can the IRS challenge a large gap between preferred price and 409A?"

Yes —” if the methodology is weak or undocumented.

No —” if the valuation is prepared by a qualified independent provider using accepted models.

"Does this gap shrink over time?"

Typically, yes.

As startups mature:

- Risk decreases

- Liquidity expectations improve

- Exit probability increases

Which narrows the spread between preferred and common values.

Best Practices for Founders and CFOs

- Never assume preferred price = common FMV

- Know when to update your 409A valuation —” especially after financing rounds

- Ensure the valuation explains the allocation methodology

- Align option grants strictly with the 409A FMV

- Maintain board and audit documentation

Final Thoughts

A 409A valuation and a preferred share price answer different questions for different audiences.

- Preferred pricing reflects investor expectations and negotiated protection

- 409A valuations reflect risk-adjusted fair market value of common stock

For founders and CFOs, understanding this distinction is essential to:

- Issue equity correctly

- Protect employees

- Maintain IRS compliance

- Avoid problems during audits, fundraising, or exits

Getting your 409A valuation right from the start sets the foundation for compliant equity compensation and smooth transactions down the road.

For a comprehensive look at all the different types of startup valuations —” including 409A, investor valuations, post-money, common stock, and exit valuations —” see our complete guide.

Related Questions

Why is common stock valued lower than preferred?

Common stock lacks the downside protection that preferred shares offer (liquidation preferences, anti-dilution, dividends). In a downside scenario, common shareholders receive value only after preferred shareholders are made whole, making common stock inherently riskier.

Does a funding round automatically change my 409A value?

A new funding round is considered a material event that typically requires an updated 409A valuation. However, the new 409A value won't simply equal the preferred price—it requires proper allocation analysis using OPM or PWERM methodologies.

When to update your 409A →What is the typical discount from preferred to common stock?

For early-stage startups, common stock is typically valued at 25-60% of the preferred price. The discount narrows as companies mature and approach liquidity events. The exact discount depends on the company's stage, capital structure, and exit probability.

How is fair market value calculated for 409A purposes?

409A valuations use methodologies like the Option Pricing Model (OPM) or Probability-Weighted Expected Return Method (PWERM) to allocate enterprise value between share classes, then apply a Discount for Lack of Marketability (DLOM) to reflect illiquidity.

Learn about OPM →Ready to Get Your 409A Valuation?

Get a compliant, defensible 409A valuation that properly allocates value between preferred and common shares.

Get Started Today